Filing Taxes can sometimes feel like a maze, especially when managing an MLM business. With so many moving parts like commissions and product sales, it is easy to see why you may find tax filing challenging. But it does not have to be overwhelming.

All income related to MLM businesses is taxable, just like the tax laws and regulations in other businesses. In this article, we will walk you through the entire process of how to file taxes for your MLM business, in an easy-to-understand, step-by-step guide. With this, you can easily navigate the process and breeze through your tax filing!!

This Article Contains:

What is MLM Tax?

MLM tax refers to the taxes paid by MLM business owners on income earned through their MLM business. As an MLM entrepreneur, understanding tax obligations is crucial for keeping your MLM business compliant while maximizing profitability. Additionally, utilizing MLM accounting software is an excellent way to simplify income and expense tracking. If you are learning how to file taxes for your MLM business, this tool is going to help in the process.

For example: You have just launched an MLM company selling skincare products. Your income will come from two main sources: Direct sales to customers and income from your distributors’ sales. You are required to pay taxes on both. You can estimate your overall tax liability for the year by accurately tracking your income and determining your MLM tax deductions for legitimate business expenses.

What essential documents are required to file MLM business tax?

As a self-employed MLM business owner, having the right documentation is crucial for a smooth tax filing process. Before you start an MLM business, understanding legal compliance is the number one key factor to consider. Ensuring that your business adheres to federal and state regulations not only protects you from potential legal issues but also establishes credibility with your customers and distributors.

Here are the essential documents you will need to gather as you learn how to file taxes for your MLM business:-

1. Schedule C (Form 1040)

This form is your primary tool for reporting your business income or loss. As a sole proprietor, you will need details about your earnings, expenses, and net profit/loss on this form. Include all income sources, such as direct sales and commissions from your distributors.

2. Schedule SE

Use this form to calculate your self-employment taxes, which cover Social Security and Medicare. You will need to file this if your net earnings exceed $400. Understanding this form is essential, as it relates directly to your overall MLM tax deductions and obligations.

3. Income Documentation

Keep records of all income received, including invoices, sales receipts, and any 1099 forms from your distributors or clients. Accurate income documentation will help you report the correct amounts on your Schedule C. This will certainly help maximize your MLM tax benefits and greatly assist you in understanding how to file taxes for your MLM business effectively.

4. Expense Receipts

Gather all receipts related to your MLM business expenses. This includes costs for product purchases, marketing materials, business travel, and other expenses incurred while running your MLM business. These will be considered under MLM tax deductions, and will significantly lower your taxable income. If you want to manage your income and expense reports, the MLM ERP software can help you generate detailed reports to simplify your Tax filing process.

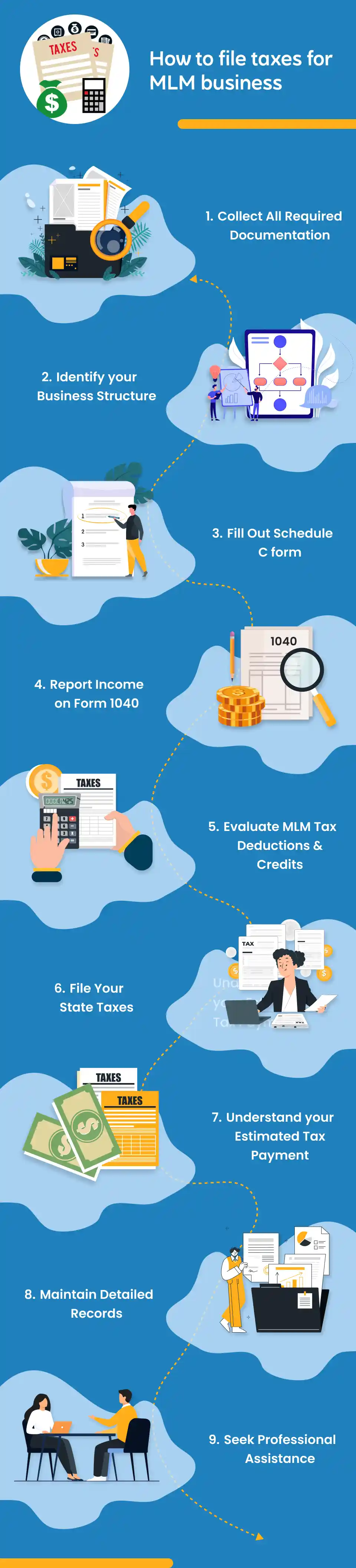

How to file taxes for MLM business- Essential Steps

Filing taxes for your MLM business doesn’t have to be overwhelming. Here is a step-by-step guide to help you navigate the process while maximizing your MLM tax benefits.

1. Collect All Required Documentation

Start by collecting all essential documents such as your Schedule C and Schedule SE. Having these ready will make the filing process easier and ensure you do not miss out on any valuable MLM tax deductions that are essential for understanding how to file taxes for your MLM business. Proper documentation is crucial for accounting for your MLM business, as it lays the foundation for accurate reporting and compliance.

2. Identify your Business Structure

Identify your business structure, whether you are operating as a sole proprietor, LLC, or corporation.This decision significantly influences how you file taxes for your MLM business, as it affects your tax obligations and the way you report your income and expenses.

3. Fill Out the Schedule C Form

Fill out your Schedule C form to document your business income and expenses. Make sure to accurately record all income sources, including direct sales and sales from your distributor network. This is crucial for claiming the appropriate network marketing tax deductions. Your business income minus your business expenses will be your net profit/loss.

4. Report Income on Form 1040

Transfer the net income calculated from your Schedule C to your Form 1040. This is where you report your total income and calculate your tax liability for the year. Understanding this step is important for anyone learning how to file taxes for their MLM business.

5. Evaluate MLM Tax Deductions and Credits

Now, this is where you review all possible deductions, such as business-related expenses, home office deductions, and travel costs. Claiming these deductions will help reduce your taxable income and enhance your MLM tax benefits.

6. File Your State Taxes

Before filing your state taxes, it is important to go through any special tax regulations that your state imposes. Tax requirements can vary from state to state and it is essential that you comply with these. Once everything is in order, you can file your taxes.

7. Understand your Estimated Tax Payment

As a self-employed individual, you may need to make estimated tax payments on a quarterly basis. Grasping this requirement is essential for avoiding penalties and managing your cash flow effectively. Additionally, your estimated taxable income can influence your product pricing and projected profits. An MLM calculator can simplify this process, allowing you to easily compute your estimated tax obligations and ensure your financial strategy is on track.

8. Maintain Detailed Records

Maintain thorough records of all transactions, income, and expenses. Good record keeping not only simplifies tax filing but also provides documentation in case of an audit. If you are looking for an easier way to track your financial activities, direct-selling software can help you greatly.

9. Seek Professional Assistance

If you find the tax process overwhelming or complex, consider seeking help from a tax professional who understands MLM business structures. They can guide you on how to file taxes for your MLM business accurately and help you take full advantage of available MLM tax deductions and more.

Conclusion

Filing taxes may not be the most exciting part of running an MLM business, but they are extremely essential for long-term success. The Good news is that with smart planning and the right tools, it doesn't have to be a headache. Maximize your MLM tax benefits and ensure compliance by keeping accurate records and using the latest tech like Global MLM Software. Make tax time easier and more efficient with us!! Connect with us now!!

FAQs

1. Are there any specific MLM tax deductions I can claim as an MLM business owner?

Yes! As an MLM entrepreneur, you can claim various MLM tax deductions for business-related expenses such as product purchases, marketing materials, and travel costs. Be sure to keep receipts and documentation to support your claims when learning how to file taxes for your MLM business.

2. Are there any tax credits available for MLM business owners?

Yes, MLM business owners can qualify for various tax credits, depending on their circumstances. It is always a good idea to consult with a tax professional to explain the specific credits that apply to your situation and ensure that you are receiving maximum tax benefits.

3. What are the benefits of filing my taxes accurately?

Filing your taxes accurately ensures compliance with IRS regulations and helps you maximize your MLM tax benefits. This can lead to lower tax liabilities through deductions and credits.

Disclaimer: Global MLM Software does not endorse any companies or products mentioned in this article. The content is derived from publicly available resources and does not favor any specific organizations, individuals or products.

Comments

Leave a Reply

Your email address will not be published. Required fields are marked *